I saw this article in the CPD and it got me thinking, who is behind the group Ohioans for Payday Loan Reform?

Figuring that out is a bit more difficult than you might think. Search on Secretary of State’s site for political group, business, non profits, etc. and you get nothing back. There is no official organization called Ohioans for Payday Loan Reform.

So let’s take a different approach. During the efforts to pass HB123, Ohioans for Payday Loan Reform was led by by Nate Coffman. He also happened to be Executive Director of the Ohio CDC Association.

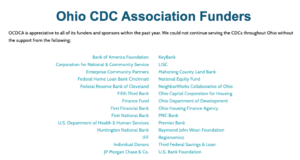

The funding for the Ohio CDC Association is pretty telling:

That’s a whole lot of banks funding a leading group in the “coalition” and effort to pass payday loan reform. And they have financial reasons to have done so. You might think its because the banks will step in and offer small dollar loans and get all that business, but this is not the case. In fact small when small dollar loans evaporate after a rate cap, banks don’t step in and offer a similar product. None other than Jamie Dimon of JP Morgan Chase told congress that you can’t offer small dollar short term loans under a 36% rate cap and make a profit (let alone a 28% cap like Ohio). The truth is that consumers who are stripped of the option of small dollar short term loans turn to another form of “credit” to cover off their needs. Study after study after study has shown that what really happens is these people turn to borrowing via overdraft. Last year, just three banks (JP Morgan, Wells Fargo, and Bank of America) made $2.2 Billion in overdraft fees alone.

So there you have it. Maybe you’re less jaded than me and thought that this was just a bunch of people standing up for the little guy. Nope. It was actually the banks trying to line their own pockets.