Sen. Sherrod Brown is calling for the minimum wage to be raised to $17 per hour as he begins what could be a hard-fought campaign for re-election.

Today’s workers cannot survive on a minimum wage salary.

It’s time to raise the minimum wage to $17 an hour.

— Sherrod Brown (@SherrodBrown) July 29, 2023

Previously, the rallying call of the far left on minimum wage had been the “Fight for Fifteen,” or $15 per hour. But it looks like just as sustained inflation under President Joe Biden has driven up the price of everything else, it’s also now contributing to calls for a higher minimum wage, too.

As yet, however, the toll inflation has taken– including the need to constrain it through higher interest rates– does not seem to have had a knock-on effect on other signature Brown proposals.

In 2019, Brown introduced a proposal to cap interest rates on short term, small dollar loans at 36 percent APR. He reintroduced that in 2021.

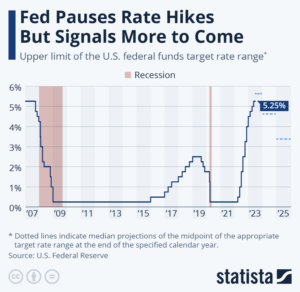

Via Statista, here’s what has been going on with interest rates over the last twenty years or so. Take a look at the period 2019-2023:

Basically, interest rates now stand at twice what they did when Brown first introduced this, and something like four points higher than they were in 2021 when he re-introduced it.

Setting aside that an interest rate cap like this would probably cause a lot of the short term, small dollar loan market to collapse leaving borrowers with limited options for credit, by Brown’s own logic, shouldn’t he at least be amending his proposal to take account of higher interest rates? If inflation justifies a $17 an hour minimum wage, surely the roughly four point hike in interest rates since 2021 justifies a 40 percent interest rate cap as opposed to a 36 percent interest rate cap.

Of course, that would also make charging $50 to borrow $500 for a week unlawful, meaning short term, small dollar loans would evaporate. But it would at least be more consistent with Brown’s logic on the minimum wage.